“Growth Catalysts: Understanding Cryptocurrencies, Supply and Demand, Movement, and Perpetual Futures”

In today’s fast-paced financial landscape, investors are constantly looking for new ways to take advantage of market trends and opportunities. Among the many investment instruments available, cryptocurrencies have emerged as a unique and volatile asset class that has captured the attention of traders and investors around the world. However, navigating the complex world of cryptocurrencies requires a deep understanding of several key factors: supply and demand, movement, and perpetual futures.

What is Crypto?

Crypto, short for cryptocurrency, refers to digital or virtual currencies that use cryptography for secure financial transactions. The most well-known example is Bitcoin (BTC), which was created in 2009 by an anonymous individual or group under the pseudonym Satoshi Nakamoto. Other notable cryptocurrencies include Ethereum (ETH), Litecoin (LTC), and Dogecoin (DOGE).

Supply and Demand

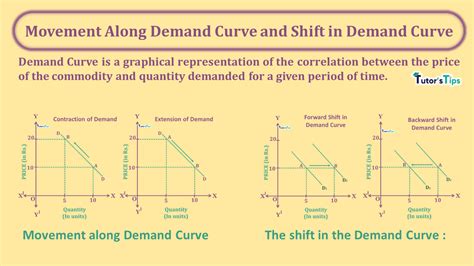

The fundamental principle of supply and demand plays a crucial role in determining the value of cryptocurrencies. When there are more buyers than sellers, prices tend to rise. Conversely, when there are more sellers than buyers, prices fall. This dynamic is influenced by a variety of factors, including:

- Market Sentiment: Positive or negative attitudes toward a particular cryptocurrency can increase or decrease demand.

- Technological Advancements: New features and updates can increase demand for certain cryptocurrencies.

- Regulatory Environment: Changes in government policies can affect supply and demand.

Movement

In the world of cryptocurrencies, movement refers to price fluctuations caused by trading activity. When traders buy or sell a particular cryptocurrency at a higher or lower price than they paid for it, it creates an upward or downward trend in the market. This is often driven by speculative factors, such as:

- FOMO (Fear of Missing Out)

: Traders may invest in a popular cryptocurrency to take advantage of potential gains.

- Panic Selling: When prices fall, investors sell their positions quickly, causing the price to fall.

Perpetual Futures

Perpetual futures, also known as perpetual contracts or perpetual swaps, are an innovative investment instrument that allows traders to bet on short-term price movements without having to actually trade a physical asset. This unique feature allows traders to profit from volatility and make predictions about market direction with unprecedented accuracy.

Perpetual futures are characterized by the following features:

- No expiration date: Prices can continue to fluctuate indefinitely.

- No margin requirements: Traders can bet on any price movement without worrying about losing their entire investment.

- Variable profit margins

– The amount of profit made depends on market movements, creating an element of risk and reward.

The potential for growth

While perpetual futures may seem complex and volatile, they offer a unique opportunity to capitalize on short-term price movements. By understanding the fundamental principles of supply and demand, movement, and perpetual futures, traders can make more informed investment decisions and potentially generate significant returns.

However, it is essential to approach these instruments with caution, as market conditions are inherently unpredictable. As with any investment, risk management is critical and traders should always prioritize proper risk assessment before entering the market.

In conclusion, understanding the key factors of cryptocurrencies, supply and demand, movement, and perpetual futures can provide valuable insights for investors looking to navigate the complex world of digital currencies. By mastering these concepts, traders can increase their chances of success in this rapidly evolving market landscape.