Building Effective Trading Strategies with ai and Machine Learning

The World of Trading has never leg more exciting, thanks to the rapid advancement in Artificial Intelligence (AI) and Machine Learning (ML). These Technologies have revolutionized the way traders approach Their craft, enabling them to make more informed decisions and maximize their potential. In this article, we’ll explore how ai and ml can be used to build effective trading strategies.

What is ai Trading?

AI Trading refers to the use of artificial intelligence algorithms to analyze market data, Identify Trends, and Execute Trades in real time. These Algorithms are programmed to Learn from historical data and adapt to changing market conditions, making them increasingly sophisticated over time.

Types of AI Trading Strategies

There are Several Types of AI Trading Strategies, Including:

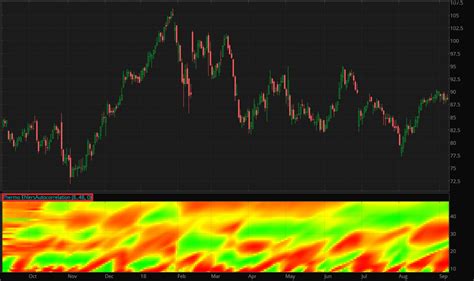

- Technical Analysis (TA) : This approach focuses on analyzing charts and patterns to predict price movements.

- Fundamental analysis : This strategy assesses the underlying fundamentals of a stock or asset, such as revenue growth or profitability.

- Statistical Modeling : This method uses statistical techniques, Such as regression analysis, to forecast market outcomes.

- Machine Learning (ML) : ML Algorithms are trained on Large datasets to identify patterns and make predictions.

How ai and ml can Help in Trading

Ai and ML CAN Significantly Enhance Trading Performance by:

- Analyzing Large Datasets : Traders can use historical data to build models that predict market outcomes, reducing the risk of human error.

- Identifying Trends : Algorithms can Quickly process fixed amounts of data to detect trends and patterns that may indicate Future Price Movements.

- Automating Trading Decisions

: AI-Powered Trading Systems Can Execute Trades Based on Pre-Defined Strategies or Algorithms, Minimizing the Need for Human Intervention.

- Improving Risk Management : ML Algorithms Can Help Identify High-Risk Assets and Adjust Trading Strategies Accordingly.

Popular AI Trading Platforms

SEVERAL AI Trading Platforms are available to traders, including:

- Fibonacci Retracement Levels : These Levels Help Predict Price Movements Based on Historical Data.

- Ichimoku Cloud Analysis : This Technique Uses Charts and Lines to Analyze Market Trends and Identify Potential Turning Points.

- Renko Chart Patterns : these patterns use candles to identify potential trading opportunities.

- Bollinger bands : these bands Measure Volatility and Help Traders Predict Price Movements.

Best Practices for Building Effective AI Trading Strategies

To Build Effective AI Trading Strategies, Follow these Best Practices:

- Start with a solid data set : Ensure that your dataset is comprehensive and accurate to minimize errors.

- Choose the Right Algorithm : Select an algorithm that aligns with your trading strategy and risk profile.

- Test and refine : Continuously test your strategies on historical data and refine them as needed.

- Monitor Performance Metrics : Track Key Performance Indicators (KPIS) Such as profit/loss, Sharpe Ratio, OR Return on Investment (ROI).

- Stay up-to-date with Market News : Regularly update Your Knowledge of Market Trends and Events to Stay Ahead of the Competition.

Conclusion

Ai and ML Have Transformed the World of Trading, Providing Traders with Unprecedented Opportunities for Growth and Profitability. By livering thesis technologies, traders can build effective trading strategies that outperform just the most experienced humans. Whether you’re a Seasoned Trader or Just Starting Out, Ai and ML Are Essential Tools to Enhance Your Trading Performance.

Recommendations

- Start by Building a Solid Data Set Using Historical Market Data.