“Crypto Investing 101: Understand Defi and its potential for high yields”

As the cryptocurrency world continues to grow, more people are resorting to decentralized finances (defi) as a way of investing in the digital economy. Dentralized Finance is an emerging financial system that operates independently of traditional banks and governments, using blockchain technology and intelligent contracts for facilities transactions.

One of the most promising aspects of DEF is its potential for high investment yields. The cryptocurrency has been known for its volatility, and prices fluctuate greatly in response to the feeling of the market. However, by investing in a well -diversified portfolio of cryptocurrencies, investors can benefit from long -term growth and income generation.

** What is decentralized financing (DEFI)?

Dentralized Finance is a general term that covers several blockchain -based financial systems, including loan platforms, loan platforms and decentralized exchange (DEXS). Defi allows users to participate in the creation of new assets, such as established, loan protocols and performance agriculture strategies.

Some key defi features include:

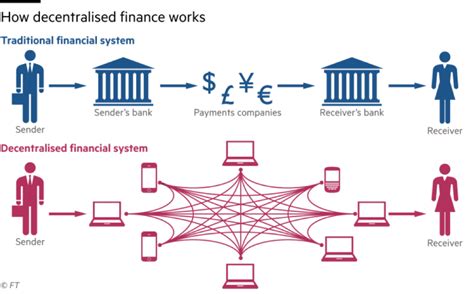

* Decentralized : Decentralized finances operate equally, without the need for intermediaries or central authorities.

* Blockchain based : Defi uses blockchain technology to enable safe, transparent and tamper proof transactions.

* Intelligent contracts : Intelligent contracts are self -expressed contracts with the terms of the agreement written directly in lines of code. They automate many tasks, such as payment processing and collateral management.

Invest in cryptocurrencies: a guide for beginners

If you are new in cryptocurrency investment, it can be discouraging to start. Here are some key things to consider:

* Research : Before investing in any cryptocurrency, investigate its underlying technology, case of use and market trends.

* Diversification : Extend your investment in a variety of assets to minimize risk and maximize potential yields.

* Risk management

: Establish clear objectives and risk tolerance before investing. Diversify your portfolio to balance risk and reward.

Popular cryptocurrencies to invest

Some popular cryptocurrencies for investment include:

* Bitcoin (BTC) : The largest and largest cryptocurrency, with a market capitalization of more than $ 1 billion.

* Ethereum (ETH) : A decentralized platform to build intelligent contracts and decentralized applications (DAPPS).

* Litecoin (LTC) : A payment system equally to the same allow rapid and secret transactions.

Power Investment Recultures

Possible investment yields for defi cryptocurrencies can be significant. For example:

* Bitcoin : Historical returns have been impressive, with some coins appreciated in 1000% or more in a single year.

* Ethereum : Ethereum’s native token, Ethher (ETH), has seen significant growth in recent years, driven by its adoption in decentralized applications and intelligent contracts.

Conclusion

Dentralized Finance offers a promising way to invest in the digital economy, with potential investment yields that far exceed the traditional investment forms. By understanding the DEFI, investigating cryptocurrencies, diversifying their portfolio and establishing clear risk management strategies, you can take advantage of the growing opportunities in this emerging market.

Remember, invest in cryptocurrencies entails significant risks, including market volatility, uncertain regulation and safety risks. Always carry out thorough investigation, establish clear objectives and use good reputation exchanges to minimize potential losses.