Market Signals and Their Influence on Bitcoin (BTC) Prices

The cryptocurrency market has been known for its volatility and unpredictability, with prices often fluctuating wildly between day and night. In recent years, the price of Bitcoin (BTC), the first and most widely recognized cryptocurrency, has been no exception. The rise and fall of various cryptocurrencies, including those in the altcoin space, have created a complex web of market signals that can impact Bitcoin’s prices. This article will delve into the world of market signals and their influence on Bitcoin prices.

What are Market Signals?

Market signals refer to any indicator or piece of information that provides insight into future price movements or trends in the cryptocurrency market. These signals can come in various forms, including technical indicators (such as moving averages, relative strength index), fundamental analysis (like economic data and sentiment reports), and even social media and news updates.

Types of Market Signals

There are several types of market signals that have been observed to influence Bitcoin prices:

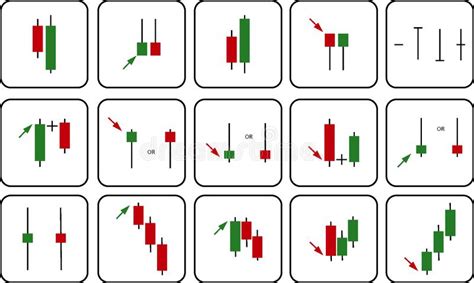

- Technical Indicators

: Moving averages, Relative Strength Index (RSI), Stochastic Oscillator, etc.

- Fundamental Analysis: Economic data, interest rates, GDP growth, inflation rates, and other macroeconomic indicators.

- Social Media Sentiment: Twitter conversations about Bitcoin, sentiment analysis of cryptocurrency news outlets.

- News Updates: Press releases, earnings reports, regulatory announcements, and other developments that can impact market sentiment.

The Influence of Market Signals on BTC Prices

Bitcoin’s price movements have been influenced by a wide range of market signals over the years. Here are some examples:

- Technological Advancements: Bitcoin’s decentralized and open-source nature has made it an attractive option for developers, which has led to increased adoption and usage.

- Fundamental Shifts: Economic downturns, recessions, or other macroeconomic events can lead to a decline in the value of Bitcoin, as investors seek safer-haven assets like gold or US dollars.

- Regulatory Developments: Changes in government regulations regarding cryptocurrencies have created uncertainty and volatility around Bitcoin’s future price trajectory.

- Social Media Sentiment: Positive social media sentiment about Bitcoin tends to be correlated with increased price movements, while negative sentiments lead to lower prices.

Case Studies: BTC Price Movements

To illustrate the influence of market signals on Bitcoin’s prices, here are some notable examples:

- 2017 Bull Run: The rise of institutional investors and hedge funds led to a significant surge in demand for Bitcoin, driving its price from around $1,000 to over $19,000.

- 2020 Market Crash: The COVID-19 pandemic caused widespread market volatility, leading to a decline in the value of cryptocurrencies, including Bitcoin.

- Regulatory Uncertainty

: In 2017, the US government passed the Financial Action Task Force (FATF) report, which raised concerns about cryptocurrency security and regulation. This led to increased speculation and price fluctuations.

Conclusion

Market signals play a significant role in shaping Bitcoin’s prices, influencing both short-term and long-term trends. While no single indicator can predict with certainty whether a market trend will hold or reverse, understanding the underlying drivers of the market can help investors make informed decisions. By staying up-to-date on the latest market developments, technical indicators, fundamental analysis, and social media sentiment, traders can better navigate the complexities of the cryptocurrency market.

Disclaimer

This article is for informational purposes only and should not be considered as investment advice.