Effect of a Lawnight Lipt Deposit (AVAX) and Crypto Currency Trading Strategies

The growth of cryptocurrencies caused a new era of decentralized stores when consumers can buy, sell and trade digital property without intermediaries like banks. One such way is the use of a liquidity base, which has proven to be a converter in the cryptocurrency market. In this article, we will explore the effect of the liquidity deposit on Avalanche (AVAX) and talk about how they can be used in various CRIPTO currency trading strategies.

What are the pools of liquidity?

The liquidity fund is an online market where traders can buy and sell property such as chips, coins or goods. The platform acts as a mediator between customers and sellers, allowing consumers to trade in property at a lower price than they could directly negotiate with each other. The platform liquidators are responsible for insurance that transactions are done properly and honestly.

Pools of Liquinity Lavina (AVAX)

Avalanche (AVAX) is a decentralized protocol of an open blockchain code, which aims to scream that everyone is creating and using intellectual contracts. The AVAX Native Platform Crypto Curry can be used as stock assets to ensure safety and integrity of transactions.

Pools of liquidity helped improve trade experience in Avalanche. By providing access to a high liquid liquid liquid liquid may be useful for users:

1

2.

3.

CRIPTO CRIPTO TRADE STRATEGIES using a liquidity field

Pools of liquidity provide many trade capabilities for both investors and traders. Here are some popular strategies using liquidity deposits:

- Market Development : Market manufacturers that provide liquidity exchange can be used as a strategy for stopping loss to determine the risk ratio of alienation, which protects trade capital.

2.

3.

- High -level betting

: traders use liquidity pools to create high crypto currencies for the use of short -term prices changes.

Benefits and risk of using a liquidity pool

Although the use of a liquidity base can provide many benefits, such as lower trade fees and increased market access, it also risks:

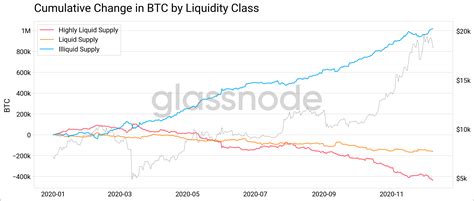

- Liquinity risk : If the pool is not liquid enough or if the funds are abruptly abolished, transactions can be implemented at adverse prices.

2.

- Safety risk : Like any Internet platform, liquefy funds are vulnerable to security risks such as burglary, fraud and other Cyber attacks.

Conclusion

Liquid pools revolutionized the landscape of cryptocurrency stores, providing a suitable and economical way of buying and selling property on decentralized exchanges. Avalanche is no exception to a reliable platform for merchants and investors to use liquidity deposits and perform transactions at lower prices. Understanding the benefits and risks associated with the use of liquidity deposits, traders can make reasonable decisions on how to use these measures in their trade strategies.